Once viewed as a nice, lowish risk source of reliable income and portfolio diversification, commercial property funds, especially those with significant exposure to bricks-and-mortar retail are at an inflection point. The traditional retail sector was already struggling in the years running up to 2020 as the growing market share of ecommerce took its toll on bricks-and-mortar shopping.

Weak UK consumer spending compared to other developed economies and the fact high street, mall and retail park rents were relatively more expensive compared to mainland Europe and the USA were not helping the sector. By 2019, around 6000 UK shops were closing their doors for good over the course of the year – double net closures a year earlier.

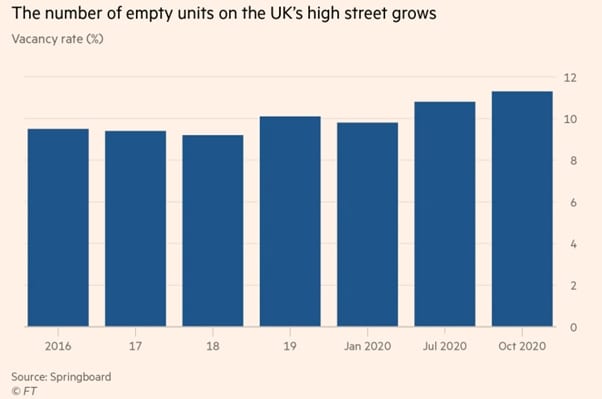

Source: Financial Times

Then came 2020 and the Covid-19 pandemic that has swept the globe, hitting the UK particularly hard. Since March last year, non-essential shops (anything other than groceries, pharmacies etc., household supplies etc.) have spent significant periods under forced closure due to lockdown measures.

Many have already admitted defeat and a record number of shops disappeared from high streets across the UK over the first half of 2020 to the end of June. A total of 11,120 chain store locations shut down, with 5119 opening. That totals net closures of 6001, both a new record and almost double the 3509 net loss of a year earlier.

Source: The Guardian

While figures for the second half of the year are not yet available, it’s inevitable they will make painful reading for anyone with exposure to the bricks-and-mortar retail sector. And landlords to bricks-and-mortar retail are no exception.

Debenhams and Arcadia Group brands including Topshop and Miss Selfridge among the big UK retail casualties

What was already a big problem for retail landlords was intensified last year by the collapse of Debenhams and the Arcadia Group. The former’s large department stores were anchor tenants for many retail zones and properties and the latter owned a number of brands that have been UK high street stalwarts for years, including Topshop, Topman, Miss Selfridge and Dorothy Perkins.

To rub salt into the wounds, the brands were acquired by the nouveau riche ecommerce upstarts ASOS and Boohoo. However, neither will take up any of the companies’ shop leases, intending to develop the brands in the new guise of online-only ecommerce operations. Debenhams’ website was one of the few assets and parts of the business to have grown in value as the department stores plunged into decline.

The shop floor-space previously held by Debenhams and Arcadia about to become vacant in England and Wales totals, calculate property adviser Altus Group, 15m square feet. The Financial Times illustrates that as representing more than 200 full-size football pitches. Vacancy rates were already high.

What happens to all those vacant retail properties now? Most is owned by property funds who are no longer generating any income from the space and will have to either find new tenants at presumably lower rental rates, sell it, or repurpose it – a huge capital expense.

Is there a new generation of bricks-and-mortar retail to step into the vacant space?

Big retail property landlords like the funds Hammerson and British Land would prefer, if possible, to re-let vacant space to new bricks-and-mortar retail tenants. That’s happened after previous downturns for the sector. And not all of the high street has suffered. Some chains have done well by finding a good balance between bricks-and-mortar and online retail.

Examples include Next, Zara, JD Sports and Fraser Group. Earlier this month, JD Sports announced plans to raise £500 million in capital to fund an aggressive expansion.

But nobody in the retail property sector is under any illusion that all the space given up over the past few years by struggling chains will be re-leased to those still doing well or new arrivals. At the root of the current retail decline has not been a lack of consumer spending. It’s a far less surmountable obstacle than economic cycles – changing consumer behaviour.

Shopless ecommerce companies have grown their share of the consumer pound and it’s a trend that almost certainly won’t reverse. Graziano Arricale, partner at private equity firm Oakley Capital, sums it up with “the high street has been dying a slow death for years now and this crisis has just accelerated it.”

Which other sectors might claim vacant retail space?

If bricks-and-mortar retail simply isn’t realistically returning to the same levels as in previous years, that means vacant space will have to be repurposed. One sector expected to take up at least some of the newly vacant space once life returns to normal post-coronavirus crisis is entertainment and ‘experiential leisure’.

Landsec, another property fund with major retail exposure, has entered into a joint venture with asset manager Invesco and trampoline centre company Gravity that will see a £4 million redevelopment of its former 80,000 sq ft Debenhams store in Wandsworth. As well as a trampoline park, the new entertainment hub will include an electric go-karting track, bowling alley, crazy golf, pool, darts and arcade games.

Otherworld, a company providing immersive virtual reality experiences says it is constantly being offered sites vacated by major retail chains. And at prices typically 30% below previous levels, and incentives such as landlords meeting some of the initial development costs.

However, again, leisure and entertainment will only realistically account for some of the former retail property now sitting vacant.

Conversion to residential or mix-used properties that mix some retail and with entertainment and leisure facilities as well as residential and office space is likely in more economically lively regional towns and cities. It would be commercially viable for landlords and, while requiring initial upfront investment, could prove profitable for investors.

There are bigger questions around how viable repurposing as residential properties would be in poorer, less economically active towns. That might require local and national government support to get off the ground and avoid vacant retail space languishing and falling into dereliction.

It might require a complete reimagining of some town centres and retail park spaces.

What does the accelerating death of bricks and mortar retail mean for investors in property funds?

Most of the popular open-ended property funds that UK retail investors have bought into held between 20% and 40% of their assets in retail property towards the end of 2019. In 2019, it is also estimated that UK REITs wrote down the value of shopping centre assets by an average of 20%, and retail parks by 35%. Open-ended direct property funds have yet to book similar devaluations.

If they do, UK investors who own direct property funds with significant retail exposure could take a heavy hit. Some analysts are predicting the 4th ‘major exodus’ from open-ended direct property funds in just 10 years. In December, M&G announced it was gating its flagship £2.5 billion fund. Brexit was an easy target to lay the blame on, with the retail sector’s struggles only mentioned as a contributing factor.

None of this means that REITs will no longer be a viable or even attractive asset class again in future. And there are currently attractive opportunities, especially in Europe, where many property funds are trading at double-digit discounts to net asset value.

But investors should carefully consider how realistic net asset values are, both when it comes to existing investments in property funds, and new opportunities. If it makes sense to cut losses and sell out of property funds now, before they are potentially gated if there are new major outflows of capital, is something to be carefully considered.

If you are invested in open-ended UK property funds, look closely at their exposure to bricks-and-mortar-retail, current vacancy rates and stated strategies for how that exposure is to be adjusted in coming months and years. And make sure you have no urgent need of capital tied up in such funds. They could be gated.